Getty Images

Briefing highlights

- Housing market shifts

- A Trump scene I’d love to see

- Markets at a glance

- U.S. consumer prices rise marginally

Whack-A-Mole

Housing speculators have been chased out of the singles market but straight into condominiums, raising a fresh threat as governments and regulators are successfully hosing down other areas.

Consider it the policy-maker version of the arcade game Whack-A-Mole.

In its latest review of the financial system, the Bank of Canada noted positive developments in household credit growth and inflated home prices. These have been driven by government and regulatory measures, such as new mortgage-qualification rules, aimed at cooling things down.

But the central bank, in its widely watched report last week, also cited the shift from higher-priced single-family homes to condos amid these changes.

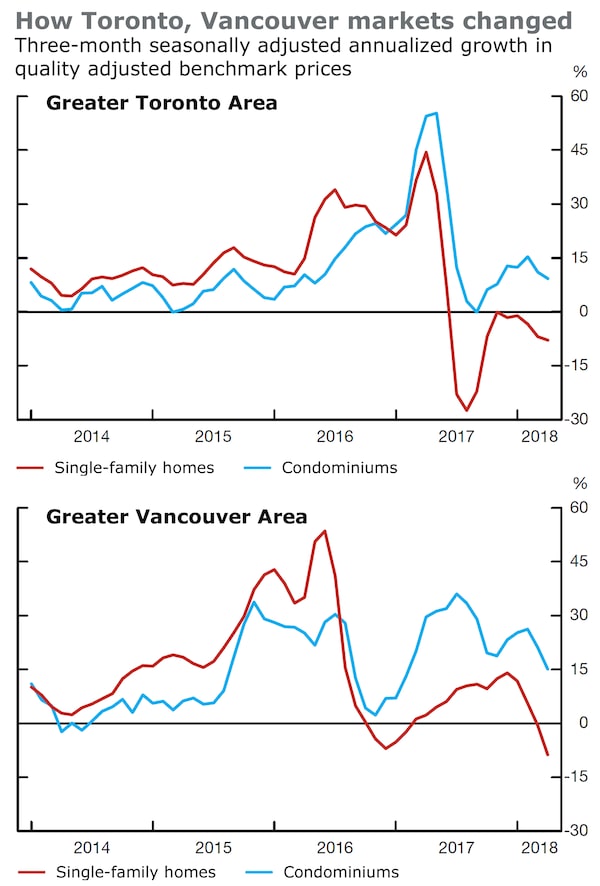

And, as always, the attention is on the Toronto and Vancouver areas, the primary focus of the measures meant to stop a bubble from bursting. Notable, too, were the Bank of Canada’s comments on speculators.

Source: Bank of Canada

“In Toronto and Vancouver and their surrounding areas, the market for single-family homes has cooled, while condominium prices have continued to grow at a rapid pace,” the central bank said.

“Economic fundamentals are driving these changes, but speculative activity may also be supporting strong price gains in condominiums,” it added.

“Over all, the vulnerability associated with imbalances in the Canadian housing market shows some signs of lessening but remains elevated.”

Look what happened in Toronto when the now-ousted Liberal government brought in its Ontario Fair Housing Plan.

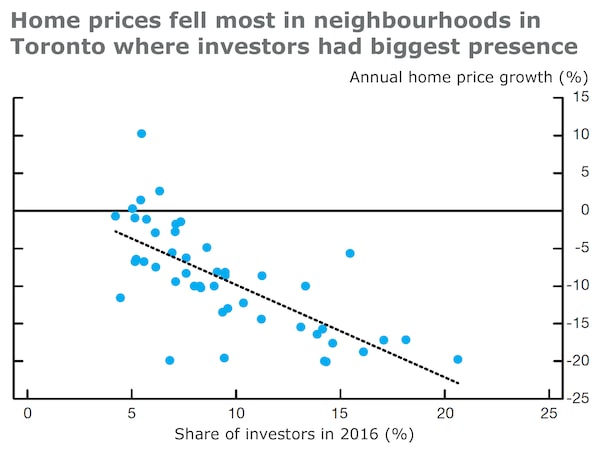

Source: Bank of Canada

“Was there ever any doubt that speculative activity was taking root in the [Greater Toronto Area] market by mid-2016,” said Bank of Montreal senior economist Robert Kavcic, referring to the Bank of Canada graphic.

“While that has long been our view, the BoC’s chart, comparing the investor share (marked by property sales immediately flipped onto the rental market v. recent price declines, shows that froth was indeed running high in some neighbourhoods, and recent measures have dampened that psychology,” he added.

“Note that while some of those investor share figures look pretty high, they’d only increase if the data also accounted for flippers (turnover within a year, perhaps?).” It would also be telling to see how the share evolved over time - though we probably already know how such a chart would look.”

Condo prices in the GTA and Greater Vancouver Area have shot up, the Bank of Canada said, noting, in particular, three-month annualized increases of 30 per cent in Victoria and 60 per cent in the Fraser Valley.

Inventories of condos that are completed and unsold are low in both the GTA and GVA, partly because of “persistent construction delays. A big but here: “Nonetheless, the number of condominiums under construction is at or near record highs in both cities, suggesting that it may be difficult to sustain the recent pace of price gains over the longer term.”

A study by Toronto-based Realosophy found “an upswing in activity by investors who were buying condominiums and then renting them out within the same year,” the central bank noted.

And therein lies the threat.

“This greater activity - even as carrying costs (including mortgage payments, property taxes and maintenance fees) have increasingly exceeded rental revenue - suggests that investors have been counting on a continuation of large price increases,” the Bank of Canada review said.

“Prices that are inflated because of these types of expectations tend to be more sensitive to adverse shocks,” it also warned.

Read more

- David Berman: Higher rates, stricter mortgage rules curbing home prices but debt still a key risk: BoC

- Carolyn Ireland: Rates, limited inventory blamed for lacklustre Toronto spring housing market

- The arresting number that says it all about Toronto’s housing market slump

- Brent Jang, Janet McFarland: Toronto, Vancouver home sales slump as buyers and sellers wait on sidelines

- The ‘sea change’ in Canadian mortgages is going to really hurt

- Janet McFarland: Home sales drop as weaker markets ‘destabilized’ by new stress tests: CREA

- Remember halcyon days and times a-changin’? Canadian baby boomers now face a housing crisis

- Refuse to sell your house at these prices? Join the (growing) club

A scene I’d love to see

Photo illustration

Read more

- Robert Fife: Trade war looms: Trump adviser says Trudeau deserves ‘special place in hell’ for criticizing U.S. tariffs

- Nathan VanderKlippe: Kim Jong-un reaffirms commitment to ‘complete denuclearization’ following summit with Trump