Briefing highlights

- Where global financial hubs rank

- Stocks, loonie, oil at a glance

- Layoffs related to GM strike mount

- Thomas Cook collapses

- Euro zone PMIs show support needed

- Required Reading

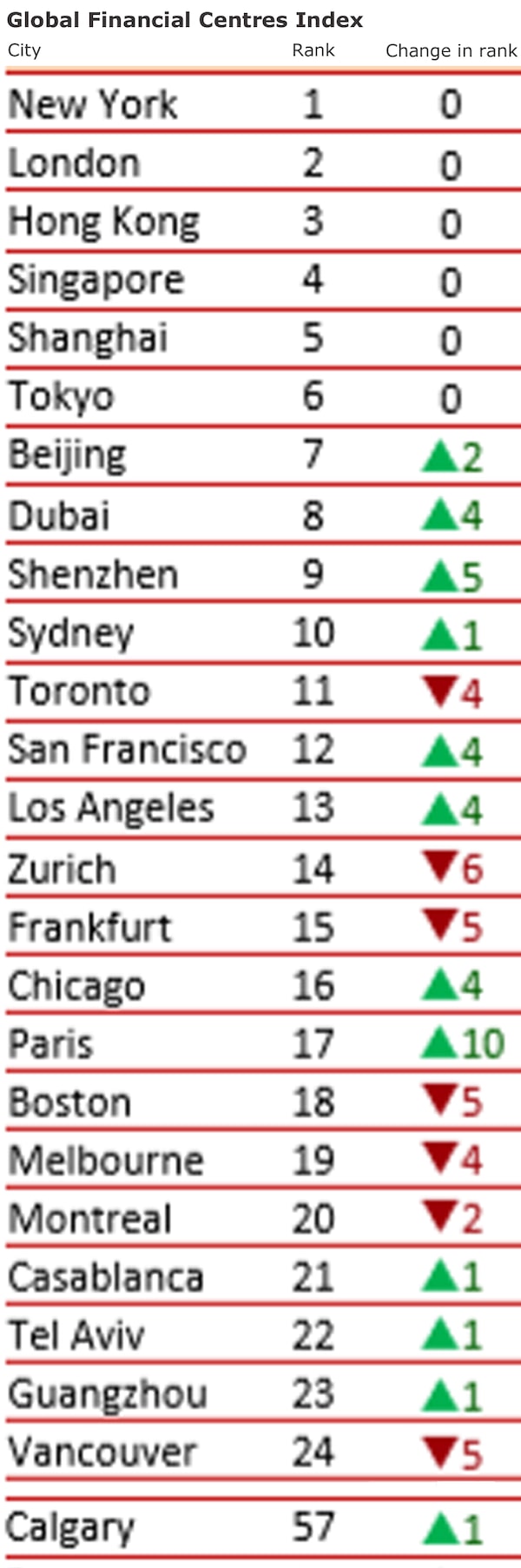

Where hubs rank

Toronto, Montreal and Vancouver all got taken down a peg (or five) in the latest ranking of global financial centres.

But Calgary, which is well down the list compared to the others, rose a notch from a year earlier in this 26th study by London's Z/Yen Group, partnering with the China Development Institute.

Toronto, home to Canada’s financial services sector and the country’s big stock exchange, dropped out of the top 10, but only just, in the ranking of 104 centres.

“Toronto still ranks 11th in the world and it is too early to say whether this fall in ratings is a trend,” said Mike Wardle, Z/Yen’s head of indexes.

Here’s how it looks, the rankings based on both data and assessments from financial industry professionals:

Source: Z/Yen Group

The study also looked at a centre’s business environment, infrastructure, the development of its financial sector, reputation and “human capital.”

Toronto ranked No. 9, and Montreal No. 12, in business environment. Toronto ranked No. 15 in financial sector development and No. 14 in reputation. Other than those instances, no Canadian city made it into the top 15 in the broad categories.

"Connectivity" was also studied as part of the report released earlier this month.

That's "the extent to which a centre is well connected around the world, based on the number of assessments given by and received by that centre from professionals based in other centres."

Here's how it works: If more than 56 per cent of the cities provide weighted assessments for a given centre, the centre is seen as "global." It's "international," in turn, if assessments top 35 per cent of the wide group.

Toronto made the grade for "broad and deep" on the list of global leaders. Vancouver ranked broad and deep under "established international." And Calgary ranked broad and deep at the local level. Montreal scored well for "reputational advantage."

Also studied via sub-indexes were banking, investment management, insurance, professional services, and government and regulatory sectors, the report said.

Toronto ranked No. 7 for professional services, No. 8 for investment management and No. 15 for banking. No Canadian city ranked in any other of these categories.

Regionally, the centres in North America ended with a "mixed performance" in this "Global Financial Centres Index 26."

“U.S. centres were the winners in this edition, with New York retaining its leading place in the index, and San Francisco, Washington D.C., Los Angeles, and Chicago all increasing their ranking,” the report said.

"By contrast, Toronto, Montreal, and Vancouver lost ground after their improvement in GFCI 25."

This survey also ranked centres as “competitive locations for fostering a fintech industry.”

Toronto ranked No. 19 out of 20 for that.

Markets at a glance

Read more

Strike-related layoffs mount

The automotive layoffs in Ontario continued to mount as the strike by 49,000 General Motors Co. workers in the United States halts the cross-border flow of parts and vehicles, The Globe and Mail’s Eric Atkins reports.

GM has stopped engine assembly work at its plant in St. Catharines, Ont., sending another 725 people home as the U.S. strike by the United Auto Workers shuts down more than U.S. 50 factories and warehouses in the United States.

Almost 3,000 GM employees represented by the Unifor union in Southern Ontario – about half GM’s hourly work force in Canada – are laid off, in addition to 1,700 Unifor employees at suppliers.

The strike in the U.S. is now in its second week, and negotiations between GM and the UAW are continuing.

Read more

- Eric Atkins: Auto layoffs in Ontario mount as U.S. GM strike moves into second week

- No end in sight as GM strike enters second week

Thomas Cook collapses

Thomas Cook threw in the towel today, stranding thousands of vacationers across the globe.

“Thomas Cook has confirmed that all the U.K. companies in its group have ceased trading, including Thomas Cook Airlines,” Britain’s Civil Aviation Authority said in a statement.

“As a result, we are sorry to inform you that all holidays and flights provided by these companies have been cancelled and are no longer operating. All Thomas Cook's retail shops have also closed.”

The CAA said it and the British government are “working together to do everything we can” to get customers of the tour company home if they’re due to fly back between today and Oct. 6.

“Depending on your location, this will be either on CAA-operated flights or by using existing flights with other airlines,” it added.

“This repatriation is hugely complex and we are working around the clock to support passengers.”

Passengers of Thomas Cook queue at Son Sant Joan airport in Palma de Mallorca Sept. 23, 2019JAIME REINA/AFP/Getty Images

The collapse of Thomas Cook has “sparked demand” for shares of other travel companies, said CMC Markets analyst David Madden.

“The demise of Thomas Cook has encouraged traders to buy into reputable travel companies, in addition to airline groups,” Mr. Madden said.

“The travel sector has seen squeezed margins recently, caused by competitive pricing, a weaker consumer climate, plus an increase in so-called staycations,” he added.

“Now that Thomas Cook are out of the picture, it is likely to remove some of the pressure from the companies that are still in operation, as fewer competitors should equate to healthier margins."

Read more

PMIs show support needed

From Reuters:

Euro zone business growth stalled this month, a survey showed, dragged down by shrinking activity in powerhouse Germany, where a manufacturing recession deepened unexpectedly.

IHS Markit’s Euro Zone Composite Flash Purchasing Managers’ Index, seen as a good guide to economic health, suggested support for stuttering activity is needed.

It sank to 50.4 in September from 51.9 in August and was below all forecasts in a Reuters poll that had predicted a reading of 51.9. That was just above the 50 mark separating growth from contraction and was its lowest since mid-2013.

Read more

Ticker

Manulife opens Irish office

From Reuters: The asset and wealth arm of Canada’s Manulife Financial Corp. said it opened an office in Ireland to expand its European operations and as part of planning for Britain’s exit from the European Union.

Wireless firm wants customers to demand underground cell service

Few of the hundreds of thousands of people who ride the Toronto subway daily can use their cellphones in the tunnel, and the company that installed the cellular infrastructure wants them to start kicking up a fuss about it. Oliver Moore reports.

Regulators to probe deal

From Reuters: EU antitrust regulators are set to open a full-scale investigation into Boeing’s $4.75 billion bid for a controlling stake in Brazilian planemaker Embraer’s commercial aircraft arm, people familiar with the matter said.

DHX changing name

From The Canadian Press: DHX Media Ltd. is changing its name to WildBrain, the name of its child-focused YouTube business, and launching a reorganization of the company.

Required Reading

How bid to privatize Callidus plunged

A Bahamas-based billionaire proposed to buy out Callidus Capital Corp.’s minority shareholders last year for nearly seven times the price eventually agreed upon. Jeffrey Jones reports.

Big Tech back in spotlight

Silicon Valley will be back under the microscope this week, with U.S. senators examining whether Big Tech’s penchant for swallowing up smaller competitors has stifled innovation, Tamsin McMahon writes. Tuesday’s U.S. Senate judiciary committee hearing into mergers and acquisitions by tech firms is the latest move in an intensifying political backlash against Silicon Valley that threatens to upend an industry that, until recently, has largely been able to write its own rules.

It’s the economy, stupid

A sound economic plan for a better Canada, not attack ads, will win votes, columnist Andrew Willis says.