Briefing highlights

- Oil’s economic toll

- GM to close Oshawa plant

- Markets at a glance

- Read our annual Board Games report

- What to expect in GDP report

- Canadian bank results on tap

- Trump to meet Xi at G20

- TD to be lead partner in Aeroplan takeover

ODV/Getty Images/iStockphoto

The crunch in Canada's oil market is taking a "drip-drip-drip" toll on the economy, with the threat of even deeper trouble.

Already, oil patch producers are pulling back and economists are cutting their forecasts for economic growth in Alberta, whose fortunes, of course, affect the country.

At this point, many are pinning their hopes on an early December meeting of OPEC producers and their allies to agree a supply cap. Never mind that President Donald Trump is pushing for lower prices, and backing Saudi Arabia in other areas, the group is expected nonetheless to agree to production cuts.

Oil prices regained some ground today after Friday’s drop, but Brent crude remained below US$60 a barrel, while West Texas intermediate, the U.S. benchmark was just above US$51.

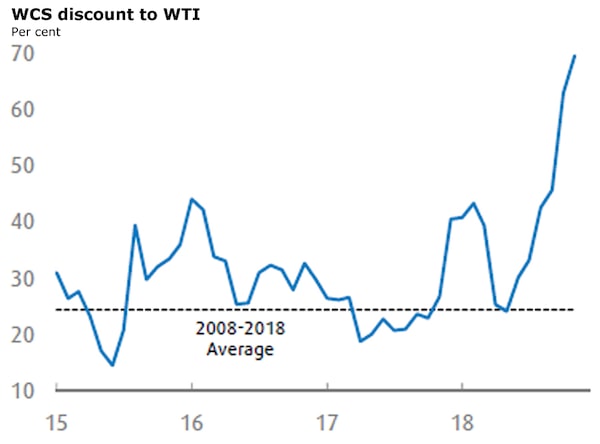

While global oil prices have plunged, much of the focus is on Western Canada Select, or WCS, a blend of oil sands bitumen and heavy oil, which has suffered an exceptional discount to Brent and WTI.

Source: BMO

“The longer the extreme lows persist for Canadian oil prices, the greater the economic damage for Alberta, and thus the national economy,” said Bank of Montreal chief economist Douglas Porter.

"The received wisdom is that WCS will mount a comeback in coming months, but in the meantime, we will keep shaving our growth forecasts on a drip-drip-drip basis until that recovery shows up in the real world," he added.

Indeed, last week BMO cut its forecast for economic growth in Alberta to 1.7 per cent from 2.1 per cent in a new projection “that’s probably about a point lower than had oil prices not gone into the tank in the past two months,” Mr. Porter said.

Toronto-Dominion Bank economist Omar Abdelrahman and senior economist Brian DePratto calculated production cuts so far will trim half a percentage point from fourth-quarter economic growth, but Canada will regain that as the WCS discount narrows next year.

That would mean only a “muted impact” on economic expansion next year, albeit “slightly more pronounced” in Alberta, with a modest hit to Saskatchewan. Production cuts are expected to shave up to half a percentage point from fourth-quarter growth in Canada, and 0.1 of a point from what would otherwise would have been projected in the first quarter.

Alberta’s growth alone could be hit to the tune of 0.2 to 0.3 of a percentage point throughout 2019.

But look out if it doesn't improve.

Source: BMO

"If current pricing holds, impacts on real activity, incomes, and government revenues would quickly mount," Mr. Abdelrahman and Mr. DePratto said in a report.

"In that instance, Alberta’s economy would be hard-hit and national Canadian growth could be cut by as much as 0.5 of a percentage point relative to our current baseline path," they added.

"Meanwhile, producers have been resorting to less-than-ideal measures in response to this. Perhaps the most significant near-term support will come from producers’ recently announced temporary production shut-ins, estimated to now surpass 160,000 barrels per day for both November and December, with the purpose of gradually balancing the existing glut."

They have also ramped up shipments by rail to record numbers to help get around pipeline constraint issues.

WCS discounts "of this extreme magnitude" tend to last no longer than a few months, Mr. Abdelrahman and Mr. DePratto said, projecting the differential to WTI will narrow to between US$20 to US$25 over the next several quarters.

Obviously, the mess in the oil market is a threat to the outlook, said Stephen Brown, senior Canada economist at Capital Economics.

"At $51 at the time of writing, WTI is dangerously close to dropping below the $50 level that we think would start to cause serious pain for the Canadian oil industry," he said in a report.

“Even if WTI remains just above $50, the drop in Western Canadian Select to just $15 per barrel is consistent with declines in production before the end of the year.”

Earl Sweet, head of economic risk at BMO, believes the oil cartel and its allies, a group observers call OPEC+, will cut supply sufficiently to see a moderate boost in prices, and that WTI will average US$62 a barrel next year.

That's down from BMO's earlier projection of US$65 a barrel. And, as Mr. Sweet noted, it's well below the US$73 a barrel, based on an average of WTI, Brent and Dubai crude, that the International Monetary Fund calculates as Saudi Arabia's fiscal break-even level.

“In Canada, producers will continue to be heavily challenged by a very wide discount from global oil prices until transportation capacity out of Alberta is increased,” Mr. Sweet said, echoing the complaints of many observers about pipeline delays.

“As oil production in Alberta continues to grow, the seemingly interminable delays to projects targeting expanded pipeline capacity to the United States (Keystone XL) and to the Pacific coast (Trans Mountain) have caused local supplies to accumulate,” he added, though, like the TD economists, he also expects the WCS differential to narrow next year, though remain high, as more oil is shipped by rail and Enbridge Inc. completes an overhaul of one its pipes.

Read more

- Gary Mason: What’s the economic Plan B for Alberta? There isn’t one

- Gary Mason: Justin Trudeau: The oil patch’s fall guy

- Globe editorial: Alberta’s disastrous oil price discount? Blame Canada

- Roll out the barrel: Canada will soon ship a pipeline’s worth of oil by rail and truck

- How large speculators are fuelling oil’s record-breaking losing streak

- Alexandra Posadzki: GMP Capital CEO forecasts turnaround for oil sector

- Shawn McCarthy: Oil exporters eyeing production cut to boost slumping crude market

- Jeffrey Jones: Husky Energy CEO sees Canadian oil discount persisting through 2020

- Shawn McCarthy: Canadian Natural Resources shuts some production amid slide in heavy oil price

- Little hope seen for oil patch activity growth as steep price discounts continue

- Imperial Oil to proceed with construction of $2.6-billion Aspen oil sands project

GM to close Oshawa plant

General Motors Co. plans to end production at five North American plants, including Oshawa, Ont., by next year, putting thousands of people out of work as the company retools to focus on electric vehicles and save US$6-billion, The Globe and Mail’s Eric Atkins reports.

“The actions we are taking today continue our transformation to be highly agile, resilient and profitable, while giving us the flexibility to invest in the future,” said Mary Barra, GM’s chief executive officer, at a press conference on Monday morning. “We recognize the need to stay in front of changing market conditions and customer preferences to position our company for long-term success.”

The Oshawa shutdown affects about 2,500 workers.

And as The Globe’s Josh O’Kane reports, workers began walking out of the Oshawa plant by the dozens, having been asked by their union to do so.

A union meeting was scheduled for this afternoon.

Read more

- Eric Atkins: GM to shut Oshawa plant, slash thousands of jobs in bid to cut $6-billion

- Josh O’Kane: GM workers walk out after calling Oshawa plant closing a ‘slap in the face’

- The end of GM’s Oshawa plant: What we know so far

- Robert Fife and Eric Atkins: GM to shut down Oshawa plant in global restructuring

Markets at a glance

Read more

Board Games 2018

See who tops and trails in The Globe and Mail’s annual rankings of corporate governance in Canada.

For the 17th consecutive year, The Globe’s Report on Business has rated the work of boards of directors using a rigorous set of governance criteria designed to far surpass the mandatory rules of regulators.

Read more

- Our comprehensive ranking of Canada’s corporate boards

- David Milstead: Growing up: Cannabis firms fall short on corporate governance

- Janet McFarland: Why three big cannabis firms scored low

What to watch for this week

Define a symbiotic relationship: Canada's economy and its big banks.

Both are in the spotlight this week as Statistics Canada reports on third-quarter economic growth and the major banks begin posting quarterly results.

“Growth popped higher in the second quarter, but momentum has slowed since then,” CIBC World Markets senior economist Royce Mendes said of what’s expected in Friday’s report on gross domestic product in the third quarter

"Household spending appears to be feeling the pinch of higher interest rates," he added.

"So is the housing market, which is also being dragged lower by tighter mortgage lending standards. Even the positive contribution from net trade will show up as a result of imports falling more than exports, rather than anything more constructive for the Canadian economy."

Analysts generally expect the report to show the economy expanded between July and September at an annual pace of between 1.8 and 2 per cent, with September alone showing a slim gain of just 0.1 per cent.

Friday's reading will feed into expectations of whether the Bank of Canada could raise its benchmark rate again in December or wait until January.

"The economy was searching for growth engines in Q3, as the one big source of support - net exports - came with a twist, since the improvement was led by a drop in imports," said BMO's Mr. Porter.

"Otherwise, look for slim gains in consumer spending and business investment, and a flat performance for housing," he added.

Before that, though, Bank of Nova Scotia kicks off its industry's fourth-quarter reporting season on Tuesday, followed later in the week by Royal Bank of Canada, Canadian Imperial Bank of Commerce and Toronto-Dominion Bank.

The quarter will be neither hot nor cold, Barclays analyst John Aiken projected in his lookahead to the bank reports.

“But a steady, uneventful close to [fiscal year 2018] may be just right: Heading into Q4, we believe the Canadian banks will deliver a solid close to the year, which should translate into mid-single-digit earnings growth for FY18,” Mr. Aiken said.

"Over all, we believe the following trends will resonate in the quarter: positive margins; steady loan growth; normalizing but still benign credit quality; weaker investment banking fees and stabilizing trading revenues; a higher [efficiency ratio] driven by a 'kitchen sink' Q4, but core operating leverage remaining positive; a more modest [foreign exchange] tailwind to the bottom line; and dividend hikes from BMO, NA, and LB," he added, the latter to referring to National Bank and Laurentian Bank.

Stock values could benefit, according to the Barclays analyst.

"While bank valuations have been caught in the broader market downdraft, we believe that there may be investor concerns of a domestic operating environment that remains challenged, underscored by slower loan growth and an economic cycle that is likely in the late innings," Mr. Aiken said.

"That said, we believe the banks' relatively defensive positioning, including steady mid-single-digit earnings growth, fairly diversified businesses to weather a slowdown, their historical 'flight to safety' trade, and a solid dividend yield of 4.3 per cent offers compelling counterpoints to fend off the bears."

Read more

What else to watch for this week:

MONDAY

It's Cyber Monday. And it's probably a good thing that the economics and earnings calendar is rather light, so you don't need to divert from online shopping for too long.

TUESDAY

Scotiabank and Alimentation Couche-Tard Inc. report quarterly results.

And in the U.S., economists expect the latest reading of the S&P Case-Shiller home price index to show a rise of 0.3 per cent in September from August, and 5.3 per cent from a year earlier.

WEDNESDAY

Not just banks, but pot, too. RBC posts its quarterly results, as does CannaRoyalty Corp.

Markets will also be watching for nods and winks from Federal Reserve chair Jerome Powell when he speaks midday to the Economic Club of New York.

Federal Reserve chair Jerome PowellAlexander Drago/Reuters

Brexit returns to the stage, with a Bank of England analysis and results of stress tests on British banks.

"U.K. banks have been in the spotlight due to recent sharp falls in their share prices," noted CMC Markets chief analyst Michael Hewson.

Britain and the EU agreed to a divorce deal on the weekend, but Prime Minister Theresa May now has to get it through her own Parliament.

"Fear of no deal has hurt the sector in the past few weeks, and these tests will be a valuable indicator as well as insurance policy for investors to reassure them that the U.K. banking sector will be capable of riding out any number of Brexit scenarios."

Read more

THURSDAY

Statistics Canada is expected to report that the country's current account deficit narrowed nicely in the third quarter, but watch what you read into that.

Economists project the shortfall will come in at about $11.5-billion to $12-billion, a far cry from the second quarter's $15.9-billion.

"In nominal terms, exports showed a healthy increase, though that was attributable to price increases rather than volumes, which were actually slightly lower during the period," said CIBC's Mr. Mendes.

"Nominal imports were roughly flat during the quarter only because prices rose as real imports were down. Given the drop in real imports, the narrowing current account deficit shouldn’t leave markets with a sense of optimism regarding domestic demand."

Watch, too, for quarterly results from TD and CIBC, and the minutes from the last Fed meeting.

FRIDAY

Besides Canada's GDP report, a lot is riding on a G20 summit in Buenos Aires, notably the expected side meeting between presidents Donald Trump and Xi Jinping, who are in the midst of a trade war.

Presidents Donald Trump and Xi Jinping meet on the sidelines of the G20 Summit in Hamburg, Germany, July 8, 2017POOL/Reuters

“Expectations have slowly been dialed down about a possible solution in the short term, with the prospect that tariffs could well increase at the beginning of next year from the current 10 per cent to an increased rate of 25 per cent,” said CMC’s Mr. Hewson.

“While deal expectations have been set to a low level an agreement to not implement the proposed increased rate at the beginning of next year could be described as progress.”

Michael Babad

Michael Babad