Briefing highlights

- The U.S.-China trade spat

- The stakes for markets, U.S. and China

- China says it won’t negotiate at this point

- An Austin Powers scene I’d love to see

- Kinder Morgan demands protection, stock sinks

- Global markets, loonie at a glance

- What to expect from housing report

- What else to watch for this week

- Canadian businesses upbeat: BoC survey

Oh, the drama

— Sal Guatieri, Bank of Montreal

The global trading system is in limbo today amid fears of a punishing U.S.-China trade war.

But, at the same time, there are hopes for a newly crafted North American free-trade agreement.

Many observers believe Washington and Beijing will eventually back away from their escalating trade battle, but warn of deep, rippling troubles if they don’t.

“And so the baseline appears to still be a process of renegotiating the U.S.-China trade and investment relationship, but now under a more significantly elevated threat of significant tariffs, and a likely trade war, should the negotiations fail,” Daniel Hui and Paul Meggyesi of JPMorgan Chase said in a report.

“And so, not too dissimilar to the NAFTA renegotiation process, markets will have to contend with a protracted period of uncertainty (the latest timeline for the ‘public comment process’ for U.S. tariffs was recently extended from 30 to 60 days, but could well be extended further) with a fat tail of a potentially catastrophic negative outcome.”

To recap, the Trump administration fired an initial volley of threatened tariffs on about US$50-billion of Chinese exports, and Beijing shot back.

Then, late last week, President Donald Trump said he wanted US$100-billion more.

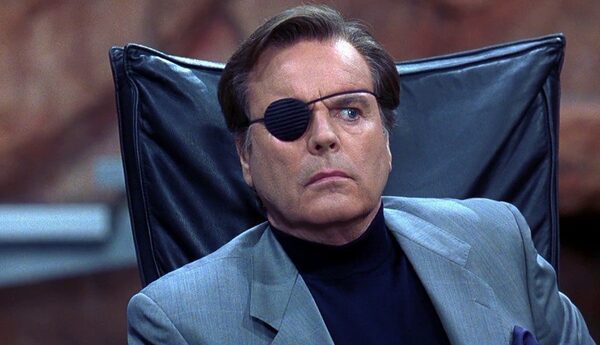

(Yes, you remember the scene in Austin Powers correctly: That’s the exact amount demanded by Dr. Evil on second thought.)

Then this weekend, Mr. Trump seemed to soften his stance, tweeting that he and China’s President Xi Jinping would always be friends, that “China will take down its Trade Barriers because it is the right thing to do,” and that “Taxes will become Reciprocal & a deal will be made on Intellectual Property.”

Today, however, Beijing again blamed the U.S. for the spat, and warned there would be no talks under “current circumstances,” Reuters reported.

“While we still think that negotiations will win out over all-out trade war, the risks of a damaging trade conflict breaking out between the U.S and China have risen,” said global economist Simon MacAdam of Capital Economics.

“If the latest U.S.-proposed tariffs on an additional US$100-billion worth of Chinese exports were implemented in full, and China retaliated in kind, this could be enough to have wider negative consequences for the global economy.”

At the same time, as The Globe and Mail’s Adrian Morrow reports, Canadian, American and Mexican officials were scrambling to get a new NAFTA in place that could be unveiled this week, though that idea has been shot down.

We’ll see how this week plays out as the U.S. administration heads toward another potential flashpoint, a mid-April decision on whether to name China a currency manipulator.

“Trump will have a chance to raise the stakes further by declaring China a currency manipulator in the U.S. Treasury’s twice-yearly report on global economic and currency policies,” noted Bank of Montreal senior economist Sal Guatieri. “Oh, the drama.”

THE STAKES

“The tariffs specified to-date won’t have a material direct impact on a US$20-trillion U.S. economy or a US$12-trillion Chinese economy,” Mr. Guatieri said.

“However, further rounds of retaliation would cause the direct and indirect costs to escalate,” he added.

“Uncertainty about how far a trade war might go would rattle business sentiment, disrupt supply chains and delay investments. It would also roil investor confidence, risking a sharp correction in equity markets that undercuts household wealth and confidence.”

Mr. MacAdam of Capital Economics said the direct impact of a trade war on a combined US$300-billion in American and Chinese goods wouldn’t actually be that big, the value of such exports accounting for only 0.8 per cent of U.S. gross domestic product and 1.2 per cent of China’s GDP.

But that’s the direct impact.

“The main way in which the tariffs would hurt the world economy in the short term would probably be through their impact on financial markets and business confidence,” Mr. MacAdam said.

“If the U.S and China do end up pulling up the drawbridge to each other, greater levels of uncertainty and a significant market selloff could discourage business investment and weigh on global growth.”

Mr. Guatieri went a step further: “With the world’s two largest economies downshifting, the global economy would likely slip into recession.”

IMPACT ON U.S.

“In the extreme, if China stopped buying from the U.S. (US$130-billion) and, for the sake of argument, American exporters couldn’t find alternative buyers, U.S. GDP would take a 0.7-per-cent hit,” Mr. Guatieri said.

“In addition, if the U.S. slapped a 25-per-cent tariff on all of China’s goods (and other countries couldn’t supplant China’s shipments with relatively low-priced goods), U.S. inflation would spike more than 0.6 percentage points.”

That, Mr. Guatieri added, would bite into consumer buying power, slowing down the U.S. economy to the tune of 0.4 per cent.

“In total, the direct impact would be a reduction in U.S. GDP growth of about one percentage point. Adding in the unknown, but clearly adverse, indirect effects could tip the scales toward a recession.”

There’s an interesting twist here because, as BMO chief economist Douglas Porter noted, the U.S. may not have bigger guns but it does have more ammunition if a trade war went to the full US$150-billion on each side.

“Naturally, China threatened to counter, but note that total U.S. exports to China amount to only US$130-billion per year, so China will soon run out of this type of ammo (while the U.S. has imported US$516-billion from China over the past year),” Mr. Porter said.

IMPACT ON CHINA

“We estimated that the initial U.S. tariff proposal would have a negligible impact on China’s broader economy,” said Julian Evans-Pritchard, senior China economist at Capital Economics.

“But assuming that the final U.S. tariff list is expanded to cover US$150-billion in imports and that China responds in kind, the hit to GDP could be closer to half a percentage point – no longer a mere rounding error.”

Here’s Mr. Guatieri’s calculation for China:

“Its exports to the U.S. account for 3.5 per cent of its GDP. If the U.S. stopped buying all of its goods (as improbable as this seems), China’s GDP growth would slow by several percentage points. This would send its jobless rate higher, consumer and business spending lower, and global commodity prices in a tailspin.”

To end peacefully, “China will need to offer meaningful concessions on market access and intellectual property protections,” said Mr. Evans-Pritchard.

“And the U.S. will have to accept that China isn’t going to abandon its industrial policy overnight, nor will the trade deficit disappear,” he added.

“But while a deal still looks possible, the ratcheting up of trade tensions clearly carries risks. The tariff threats, even if only intended as bargaining tools, will be difficult to back down from if talks fail to deliver results.”

NAFTA

“We were concerned that more worrying aspects of the U.S. administration’s trade agenda (e.g. with China) might poison prospects for a successful NAFTA negotiation,” said JPMorgan’s Mr. Hui.

“But several developments on the NAFTA front in recent weeks make us question the extent to which CAD is currently discounted,” he said, referring to the Canadian dollar by its symbol.

As The Globe’s Mr. Morrow reports, the NAFTA teams had hoped for a deal they could sign this week at the Summit of the Americas in Peru.

Mexico’s economy minister, Ildefonso Guajardo, said today, however, that isn’t going to happen, though the chances of a deal by early May are good.

“While details would still need to be ironed out, such an outcome would allow U.S. trade negotiators to concentrate their efforts on levelling the playing field with China,” said Toronto-Dominion Bank senior economist Michael Dolega.

“Canada’s trade relationship with the U.S. remains, by-and-large, balanced,” said Toronto-Dominion Bank senior economist Michael Dolega.

“NAFTA 2.0 would be positive in removing uncertainty for businesses on both sides of the border but the deal is unlikely to bring back manufacturing jobs to Canada or the U.S. en masse,” he said.

How the Trump administration is approaching this seems clear:

“The flexibility and differentiation shown by the U.S. towards NAFTA, even as rhetoric and action against China has ratcheted up in the past two weeks, suggests a compartmentalization of the NAFTA issue from other U.S trade policy initiatives,” said Mr. Hui and Mr. Meggyesi.

Settling NAFTA could benefit Canada in more ways than one if the Trump administration keeps the pressure on Beijing and, of course, if that doesn’t send the world to hell in a handcart.

“Barring a potential global recession, the tougher stance towards China could work in Canada’s favour, offering an opportunity to fill some of the demand previously satiated by Chinese products,” Mr. Dolega said.

“This is already apparent in the case of aluminum and steel, with more industries likely to be presented with an opportunity not available since the turn of the century - when China joined the [World Trade Organization],” he added.

“This opportunity will be all the more apparent should a modernized trade pact, or NAFTA 2.0, be signed soon.”

MARKET IMPACT

Given the stock market volatility to date, it’s not hard to imagine the fallout should the U.S. and China escalate to an all-out tariff war.

“The bar to further equity gains is still strong,” IG chief market analyst Chris Beauchamp warned on Friday.

“Trump’s threat to introduce more tariffs, although still just a threat at this stage, reinforces the idea that neither side is prepared to back down,” he added. “Such an environment augurs badly for a resumption of the rally.”

On the currency side, the Canadian dollar has already enjoyed the more optimistic outlook for a new NAFTA.

“While there are numerous idiosyncratic CAD factors in play, some more relevant than others (e.g. we think the oil transport bottleneck is modestly relevant but housing market risks are much less relevant near-term), the unique risks to U.S. trade policy has been the most prominent and obvious candidates for driving CAD [foreign exchange] risk premium, given the unique exposure to NAFTA, to steel and aluminum tariffs, and due to its large footprint to U.S. import demand,” Mr. Hui said.

“Hence, a material NAFTA breakthrough which narrows these trade risks should materially impact CAD’s risk premium.”

Of course, how the U.S. dollar could react to a US.-China tariff war would be a big factor.

When you look at the two sides, said Andrew Grantham and Katherine Judge of CIBC World Markets, Beijing’s tit-for-tat tariffs would threaten the U.S. trade balance more than the other way around.

“That’s because American producers have recently relied more heavily on demand from China to support growth in exports of goods that face impending tariffs,” Mr. Grantham and Ms. Judge said in a report.

“That could actually see the U.S. trade deficit widen while posing barriers to growth in those heavily export-exposed industries,” they added.

“That would add to the already broadly negative prospects for the USD stemming from improving global economic growth and the steady removal of monetary accommodation in other major economies.”

The U.S. dollar, in turn, will see weakness again, said Bipan Rai, North America head of foreign exchange strategy at CIBC World Markets.

“The USD bearish theme will rear its head again when the current tactical regime ends,” he said.

“Global fundamentals look too good and the convergence story still has some ways to go. Once ‘headline’ volatility fades, expect strategic themes to come back to the fore.”

Read more

- NAFTA’s saga so far: A guide to trade, the talks and Trump

- Barrie McKenna: Chinese ambassador to Ottawa decries ‘looney’ Trump trade tactics, calls for Canadian support

- Trump threatens more China tariffs as Beijing vows ‘fierce counter strike’

- Adrian Morrow: NAFTA talks continue in Washington, although top officials exit

- Barrie McKenna: The looming ‘symbolic’ NAFTA deal is a long way from the real thing

- From pacemakers to the pill, Trump ‘brought a knife to a gun fight’ in China trade spat

- David Parkinson: U.S. and China’s trade shoving match undermines WTO law

- Eric Atkins: U.S.-China trade war hits Canadian farmers as oilseed prices fall

- Campbell Clark: Will Trump accept a NAFTA deal that comes with concessions?

- Robert Fife, Adrian Morrow, Greg Keenan: NAFTA partners race to resolve conflict on auto sector ahead of Peru summit

- China retaliates, unveils additional tariffs

- Adrian Morrow, Greg Keenan: Canada demands concessions from U.S. as NAFTA deal nears

An Austin Powers scene I’d love to see

Photo illustration

Kinder Morgan demands protection

Kinder Morgan is demanding protection for its shareholders and a clear path of construction in British Columbia in order to save the $7.4-billion Trans Mountain expansion project.

The company would be open to Alberta government investment in the project but that would not be enough to put it back on track, Kinder Morgan Inc. chief executive Steven Kean said on a conference call today, The Globe and Mail’s Shawn McCarthy, Kelly Cryderman and Ian Bailey report.

Instead, the Houston-based firm has set a much higher bar in order to proceed: certainty that British Columbia will not be able to block or delay construction, and assurances that its shareholders will not be hurt financially.

This came as the Canadian unit’s shares tumbled.

Kinder Morgan has suspended all “non-essential” spending on its Trans Mountain pipeline expansion due to opposition from the British Columbia government, and established a May 31 deadline for governments to meet its conditions.

Read more

- Kelly Cryderman, Ian Bailey: Kinder Morgan issues ultimatum, suspends ‘non-essential’ spending on Trans Mountain pipeline

- Jeffrey Jones: Despite terrible timing, Kinder Morgan’s message makes sense

The fear is that we have two stubborn and headstrong leaders who are unlikely to cave in

— Joshua Mahony, IG

Markets at a glance

Read more

What to watch for this week

That sound you hear this week will be the thud of Canadian home sales.

We’ve already seen reports from several local real estate boards, notably those in Toronto and Vancouver, so we know Friday’s national look from the Canadian Real Estate Association won’t be pretty.

This comes amid new mortgage qualification rules from the Office of the Superintendent of Financial Institutions, the commercial bank regulator, which added to measures from the Ontario and B.C. governments to cool the housing and debt markets.

Benjamin Reitzes, Canadian rates and macro strategist at BMO Nesbitt Burns, expects Friday’s report to show home sales across the country tumbled 17 per cent in March from a year earlier, or “a bit worse than the prior month.”

As The Globe and Mail’s Janet McFarland and Brent Jang report, Toronto and Vancouver readings have already highlighted hefty declines, though Toronto prices are stabilizing.

“The broader market continues to adjust to stricter mortgage regulations, with Toronto cooling sharply amid a 40-per-cent plunge in activity,” Mr. Reitzes said.

“While the same can be said of B.C., Vancouver, Fraser Valley, Victoria and the surrounding regions also had to deal with an increased foreign buyers’ tax that was introduced as part of the B.C. budget,” he added.

“There were steep declines in Calgary, Windsor and London, as well, while Ottawa was one of the few bright spots with sales up double digits (thank you, higher federal government spending).”

Mr. Reitzes also expects the report, the third of three on the housing sector this week, to show average prices down 5 per cent from a year earlier, but the MLS home price index, considered a better measure, up 6 per cent.

Don’t read too much into that last number because it would still mark the slowest pace in almost three years.

Even aside from home sales, it’s a relatively busy week, with a market focus on the Bank of Canada, the tit-for-tat rat-a-tat-tat from trade officials in Washington and Beijing, and the start of U.S. bank earnings.

Read more

- Janet McFarland: Toronto home prices rise for third straight month

- Brent Jang: Vancouver townhouse prices set record

- Many Canadian home buyers in for a shock. And that’s aside from the price

TUESDAY: FIRST LOOK

Today brings the first look at the real estate market as Canada Mortgage and Housing Corp. reports on March construction starts and Statistics Canada on February building permits.

Analysts expect to see a 5.1-per-cent decline in the former, to an annual pace of about 218,000, and 2-per-cent drop in the latter.

“A more sluggish pace to housing starts in March lines up with our forecast that residential activity is set to cool this year,” said Royce Mendes of CIBC World Markets.

“Look for starts to clock in just below 200,000 in 2018, down from 220,000 last year as the slowdown in single-family construction outweighs any pickup in condos.”

Delta Air Lines Inc. also reports quarterly results.

WEDNESDAY: MINUTE BY MINUTE

Much on tap for watchers of the Federal Reserve and interest rates.

First up is the U.S. government report on inflation, which economists expect to show no change on a monthly basis, but possibly a slighter higher pace of 2.4 per cent year over year.

Later in the day come the minutes of the last Fed meeting, when the U.S. central bank raised rates by one-quarter of a percentage point and its projections suggested at least two more increases this year.

Federal Reserve chairman Jerome PowellJoshua Roberts/Reuters

“At the start of the year, there was a lot of chatter that the Fed could hike rates four times in 2018, and the minutes could provide a better insight into what the U.S. central bank might do in terms of future monetary policy,” said CMC Markets analyst David Madden.

Watch, too, as China releases inflation numbers. Chang Liu of Capital Economics expects those reports to show the annual rise in consumer prices creeping up to 3 per cent last month, and the producer price index easing to 3.5 per cent.

THURSDAY: CARNEY COMES HOME

Mark Carney, who the Bank of England stole from the Bank of Canada, speaks at a Toronto economic summit.

Bank of England Governor Mark CarneyVictoria Jones

He’s got a lot on his plate, what with Brexit and all, but he’s never been shy when it comes to talking about his home turf, particularly on the housing front.

And, who knows, maybe he’ll talk about how he’d like to be prime minister one day. Of Canada, where things might be easier as we’ve got no one to separate from.

Today also brings the second look at the housing market with the release of the Teranet/National Bank home price index, which Capital Economics expects to show a slower annual pace of 6.4 per cent in March from February’s 7.5 per cent.

“It could take another five months before the annual Teranet inflation rate turns negative,” said David Madani, senior Canada economist at Capital Economics.

And some earnings to note: BlackRock Inc., Brick Brewing Co., Cogeco Inc. and Cogeco Communications Inc., and Shaw Communications Inc.

FRIDAY: WELL, IT IS THE 13TH

Watch for China’s trade report. God knows, President Donald Trump will be.

Capital Economics expects it to be fairly balanced.

A good day for it, too, as it comes on the first day of the Summit of the Americas in Lima.

Also key today is the start of the U.S. bank earnings season, with Citigroup Inc., JPMorgan Chase & Co., PNC Financial Services Group Inc. and Wells Fargo & Co. all reporting.

“The banking sector has been hit by falling trading revenue,” said CMC’s Mr. Madden, noting declines in earnings from fixed income, currencies and commodities.

“In the latest reporting season the major U.S banks had one-off tax bills in relation to the new tax laws in the U.S., and now that is out of the way, we could see reduced tax bills,” he added.

“The recent interest rate hike by the Fed should assist the banking sector, as a higher interest rate environment helps lenders.”