Briefing highlights

- Canadian auto sales ‘winded’

- Markets at a glance

- Investors eye U.S.-China trade talks

- What to expect from Bank of Canada

- What else to watch for this week

- From today’s Globe and Mail

Whither auto sales

Still reeling from General Motors Co.'s decision to shutter its key Oshawa, Ont., operation, Canada's auto industry has now suffered the second of a "heavy one-two punch" on sales.

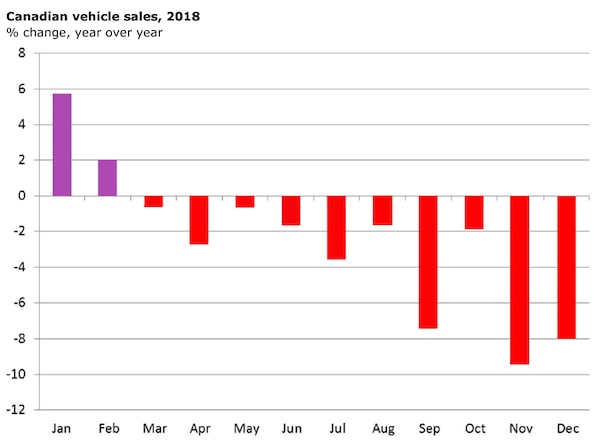

The latest numbers show vehicle sales ending the 2018 calendar year with a nasty December tumble.

"December’s 8-per-cent year-over-year decline in Canadian vehicle sales on the back of November’s plunge dealt a heavy one-two punch to the auto selling cycle," said Bank of Montreal senior economist Alex Koustas.

"The year-end figures are an emphatic confirmation that auto sales are well and truly winded, and the tale of the tape points to a continued decline in 2019."

Source: Bank of Montreal

DesRosiers Automotive Consultants Inc., however, pointed to the fact that car and light truck sales came in at about 114,290 units, which is "still a solid total for what is traditionally a slow month."

Further, it capped a year that saw sales at 1.985 million units, the market having topped the 2 million mark for the first time only a year earlier.

“Before the naysayers shriek out their first calls of doom and gloom, it bears mention that 2018 nestled itself comfortably as the year with the second-highest sales on record – down only 2.6 per cent from the lofty heights achieved in 2017,” DesRosiers said.

"Some momentum carried over from 2017 into early 2018 as January and February sales set new sales records but the industry gradually lost steam during the second half of the year, ending with the first year-over-year decline since 2009."

BMO's Mr. Koustas noted light truck sales, key to the market of late, fell 6.5 per cent in December, while sales of luxury vehicles, which have "mostly glided above the slugfest for market share in the standard segment," tumbled 10 per cent.

Over all, "despite 10 straight months of year-over-year declines, the annual sales tally likely topped 2 million units for only the second time on record (if heavy trucks are included), a very healthy figure by any measure," Mr. Koustas said.

"Not bad for dealerships, but auto sales are now surely poised to act as a headwind on consumer spending growth for the remainder of the cycle."

This is key, of course, because higher interest rates, and increases to come, will force consumers to juggle their budgets carefully, particularly given high household debt levels.

And that's just one of the reasons Royal Bank of Canada projects "fewer visits to the car lot" this year.

"Even before being pinched by rising interest rates, fewer Canadians were buying autos, in part reflecting a potent combination of technology and demographics," RBC's economics department said in its 2019 outlook.

"For those living in urban areas, there’s been an explosion in ride-sharing and car-sharing services, like Uber and ZipCar, while research has found the number of young people with driver’s licenses has been waning," the RBC economists added.

Indeed, the drop in Canada has been steeper than that in the United States.

"Now, add in the impact of higher interest rates, which will eat into household discretionary income and force some consumers to decide just what they can live without," RBC said.

"Will a new set of wheels be near the top of that list?"

Read more

Markets at a glance

Read more

What to watch for this week

Call it the Big Pause.

Having held off raising interest rates in December, the Bank of Canada is again expected to hold its benchmark steady Wednesday.

But, of course, markets will watch for signals from its statement and accompanying monetary policy report.

Expect governor Stephen Poloz, senior deputy governor Carolyn Wilkins and their colleagues to keep the overnight rate at 1.75 per cent, while trimming forecasts for economic growth given the turmoil in oil markets.

That doesn't mean they're done raising interest rates from the lows of the crisis era and the subsequent oil shock, only that they'll put off the inevitable until March or April before tightening our purse strings again.

Depending on how things play out, of course. Uncertainty abounds on the oil and trade fronts, all of which will factor into the central bank's timeline.

Bank of Canada senior deputy governor Carolyn Wilkins and governor Stephen PolozAdrian Wyld/The Canadian Press

"We see the tone of the statement being along the lines of 'we'll get back to you later,' rather than 'we're all done here, people,' in terms of further interest rate tightening," said CIBC World Markets chief economist Avery Shenfeld.

"That would open the door to a rate hike as early as April if oil prices have managed to rebound by then, and oil inventories in Alberta don't look as bloated."

Alberta has ordered the oil patch to temporarily cut production in an effort to buoy prices. And, indeed, Premier Rachel Notley's intervention in the market narrowed the discount on Canadian crude against global benchmarks.

That, in turn, will eat into economic growth, which should be reflected in Wednesday's monetary policy report.

"Despite the improvement [in western Canadian crude prices], the sector is going to be a key reason behind expected downgrades to the growth forecast," said Benjamin Reitzes, BMO's Canadian rates and macro strategist.

"Look for 2018Q4 GDP to be cut nearly one percentage point to around 1.5 per cent, while 2019Q1 will be introduced at about 1 per cent," he added.

"Those figures would cut the annual pace of growth at least a tick, with a larger impact if the rest of 2019 isn’t upgraded."

Like some forecasters, Bank of America Merrill Lynch expects the Bank of Canada to start raising rates again in March or April, followed by another increase in October.

“We believe there is no room for the BoC to hike in January,” Carlos Capistran, Bank of America’s Canada and Mexico economist, foreign exchange strategist Ben Randol and rates strategist Olivia Lima said in a lookahead to Wednesday’s decision.

That's because annual inflation is below the central bank's target of 2 per cent, oil prices remain under pressure, U.S. economic growth is forecast to slow, and the Federal Reserve is now more "dovish," meaning its rate increases are expected to be slower than initially expected this year.

"As we adjust our expectations for BoC and Fed hiking in 2019, we also expect a lower trajectory for Canadian rates," Mr. Capistran, Mr. Randol and Ms. Lima said.

"Our U.S. economics team is now calling for two Fed hikes in 2019, and we believe that the BoC will continue to hike in line with the Fed, retaining similar near-term policy paths," they added.

"However, given the BoC did not hike in December, the average policy rate spread between the BoC and the Fed has increased to 75 basis points."

Read more

- Arrested wealth, steeper rates, unaffordable housing: How we’ll be pinched in 2019

- Why TD dreads a ‘Beetlejuice’ recession: The cases for and against a 2019 bust

- Scott Barlow: Wall Street economist warns global economic growth ‘now in free fall’

- Investors are still cautiously optimistic about 2019. But here’s what could go wrong

- Trouble ahead: Eric Reguly’s business and economic predictions for 2019

- Onset of U.S. recession may take longer than expected after yield curve inverts

Here's what else to watch for this week, and there's a good chance some U.S. indicators will be delayed because of the partial government shutdown:

MONDAY

American and Chinese trade negotiators return to the bargaining table, but "we do not expect a material resolution of trade tensions yet," said economists at Citigroup.

"Chinese officials have announced numerous measures ahead of the meeting, but these are unlikely to satisfy the hawks in the U.S. administration," added Chang Liu of Capital Economics.

Corporate results also begin to roll out, starting with T-Mobile USA Inc.

Read more

TUESDAY

Statistics Canada is expected to report the country's trade deficit widened in November. The question is by how much.

Economists expect the report to show the gap swelling to somewhere between $1.4-billion and $2.8-billion from October's $1.2-billion.

"A number of factors likely conspired to leave the trade deficit wider in November," said CIBC senior economist Royce Mendes.

"And, that’s even despite a rebound in the volume of oil shipments sent south of the border," he added.

"Falling global oil prices, and widening Canadian heavy crude spreads [before the Alberta measures] meant that in nominal terms oil exports likely declined. Moreover, the weaker Canadian dollar will have made imports in general more costly for domestic purchasers."

WEDNESDAY

Besides the central bank decision and monetary policy report, Canada Mortgage and Housing Corp. releases its reading of housing starts, which economists believe fell about 2.8 per cent to an annual rate of 210,000, or possibly less.

Toronto-Dominion Bank, for example, expects to see an annual pace of 205,000, which would put the full 2018 number at about 213,000.

That latter figure would trail 2017's 220,000 but, notably, "our forecast is consistent with only 55,000 single-unit starts in urban areas, which is only slightly above the worst year on record from 1982," TD said.

The Fed also releases the minutes of its last meeting.

On the corporate front, watch for quarterly results from Constellation Brands Inc.

THURSDAY

All eyes will be on a midday speech by Fed chair Jerome Powell to a business audience in Washington.

Federal Reserve chair Jerome PowellChristopher Aluka Berry/Reuters

And Statistics Canada releases its November measure of the value of building permits, which economists generally expect to show a monthly rise of 1 per cent.

Several companies also report quarterly results, including Cogeco Inc., Cogeco Communications Inc., Delta Air Lines Inc. and Postmedia.

Read more

FRIDAY

Markets will be watching closely for the U.S. inflation reading given what it could signal for the Fed, and analysts project the headline annual number will come in at a slower pace of 1.9 per cent on lower prices at the gas pump.

"The Fed’s preferred measure of inflation, core PCE prices, should remain just below the 2-per-cent target in December," said CIBC economist Katherine Judge.

"And with inflation where the Fed wants it to be, their attention will turn to growth indicators to dictate policy moves."

Watch, too, for results from Aphria Inc., which should be interesting given how it has become the target of short sellers.